TBC Bank Shares Slide, as National Bank asks Board Chair, Deputy to Exit

The National Bank of Georgia (NBG) has issued a statement (available in Georgian only) giving TBC Bank’s shareholders two months notice to remove the Chairman of the Supervisory Board, Mamuka Khazaradze and his deputy Badri Japaridze from the Supervisory Board. The NBG said this decision does not affect the status of the two as shareholders.

The NBG says its decision is linked with the cases of “violations of the legislation related to the conflict of interest” in transactions dated 2007-2008, unveiled during the examination of the TBC Bank’s accounts.

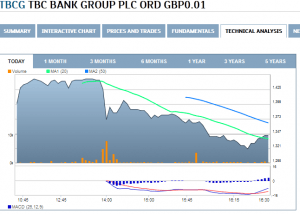

TBC Bank (TBCG) is listed at the London Stock Exchange under FTSE250. Its shares slid on the announcement by 6,65%. The live status of trades at LSE is available here.

TBC Bank’s response

In its official statement, the bank said it will challenge the decision of NBG in courts and pledged to protect the interests of the bank and its shareholders. Seeking to reassure shareholders, the bank also addressed the LSE saying that Khazaradze and Japaridze will continue to hold their positions as board members and Chairman and Vice-Chairman of the Supervisory board of TBC PLC, a public limited company registered in England and Wales that was incorporated in February 2016. TBC PLC is the parent company of JSC TBC Bank (“TBC Bank”) since 10 August 2016. TBC PLC is listed on the London Stock Exchange under the symbol TBCG.

Chairman Defends his record

Mamuka Khazaradze, in a statement published via social media said “we won’t surrender our business, our freedom, and our dignity”. He cast doubt on an “expedited decision” taken by NBG, as well as the “campaign to mar the reputation” of the Bank.

He linked the campaign to the construction of the deep-sea port of Anaklia , wherein TBC Holding leads the consortium also involving Conti International from the United States, SSA Marine from the United States, British Wondernet Express, and G-Star Ltd. from Bulgaria.

Khazaradze also claimed that the 11-year-old transactions sanctioned by NBG were audited by Dentons, which “not only found no trace of money laundering, abuse of office or any other criminal offense, but established that there was no conflict of interest.”

This post is also available in: ქართული (Georgian) Русский (Russian)